Key findings:

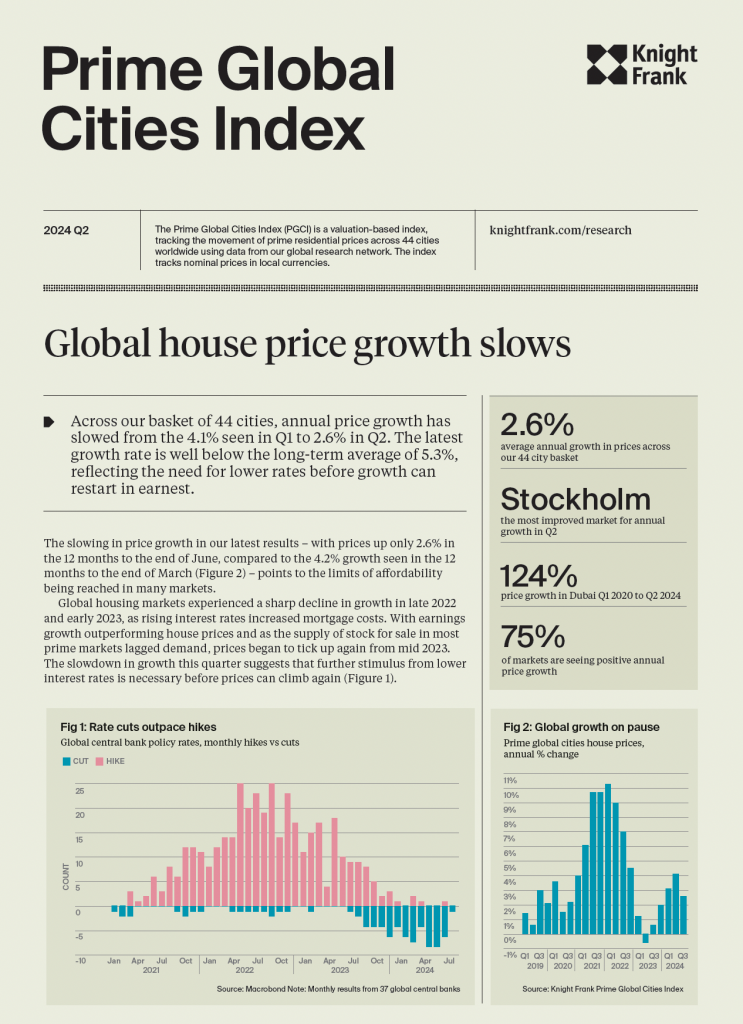

- Across the 44 cities tracked, annual price growth has slowed from the 4.1% seen in Q1 to 2.6% in Q2.

- The latest growth rate is well below the long-term average of 5.3%, reflecting the need for lower rates before growth can restart in earnest.

- Stockholm is the most improved market for annual growth in Q2 2024.

- Dubai registered a price growth of 124% from Q1 2020 to Q2 2024.

- 75% of markets are seeing positive annual price growth.

Liam Bailey, global head of research at Knight Frank said:

“The slowing in price growth this quarter across global prime markets reflects the fact that, without further stimulus from rate cuts, the bounce in market pricing we have seen over the past few quarters is running out of steam. The biggest influence on future price growth lies in the hands of central banks and their confidence to cut rates further over the next 12 months.”