Dublin Industrial Market Q1 2020: 87,000 sq m of industrial space transacted in Q1, 17% behind the 104,000 sq m that was taken during the same quarter last year. However, this still represents a strong start to the year, sitting above the three-year quarterly average of 75,000 sq m.

Take-up was concentrated in the North-West and the South-West of Dublin, accounting for 56% and 43% of the market respectively.

Although there were just two deals in excess of 10,000 sq m, together they accounted for 57% of takeup. The largest of these was the letting of 30,000 sq m to Dunnes Stores at the former Geodis facility at Damastown Industrial Park, followed by the taking of 19,800 sq m by an undisclosed occupier at the Former Lufthansa Technick site on the Naas Road. The supply of newly delivered units also played an important role in supporting transaction volumes: Unit 527, Greenogue Business Park (6,800 sq m) was taken by Amazon, thus establishing their first warehouse in Ireland, while Harrier House, Dublin Airport Logistics Park (3,600 sq m) was taken by Dnata.

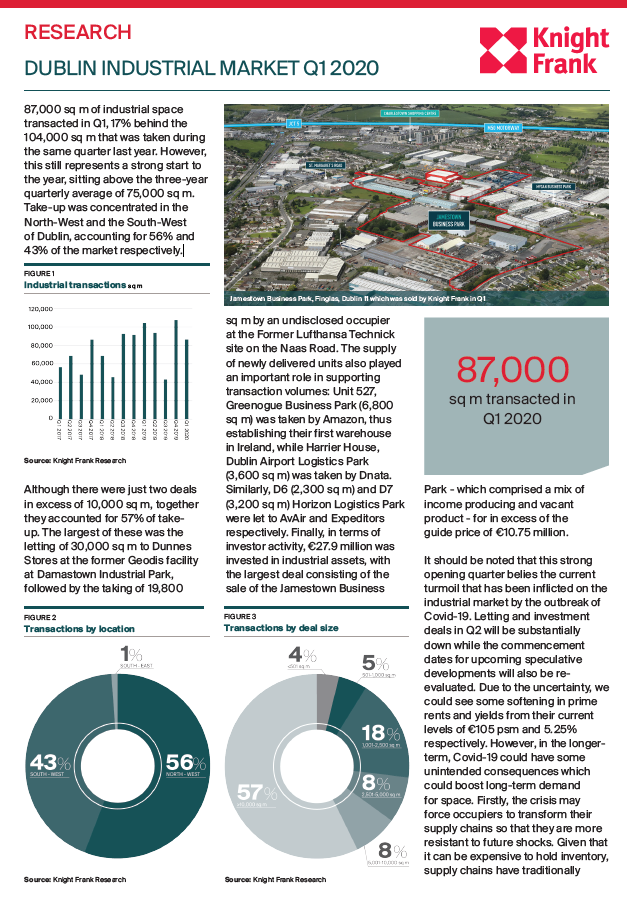

Similarly, D6 (2,300 sq m) and D7 (3,200 sq m) Horizon Logistics Park were let to AvAir and Expeditors respectively. Finally, in terms of investor activity, €27.9 million was invested in industrial assets, with the largest deal consisting of the sale of the Jamestown Business Park – which comprised a mix of income producing and vacant product – for in excess of the guide price of €10.75 million.

Impact of Covid-19

It should be noted that this strong opening quarter belies the current turmoil that has been inflicted on the industrial market by the outbreak of Covid-19. Letting and investment deals in Q2 will be substantially down while the commencement dates for upcoming speculative developments will also be re-evaluated. Due to the uncertainty, we could see some softening in prime rents and yields from their current levels of €105 psm and 5.25% respectively. However, in the longer term, Covid-19 could have some unintended consequences which could boost long-term demand for space. Firstly, the crisis may force occupiers to transform their supply chains so that they are more resistant to future shocks. Given that it can be expensive to hold inventory, supply chains have traditionally been designed to keep inventory levels low.